-

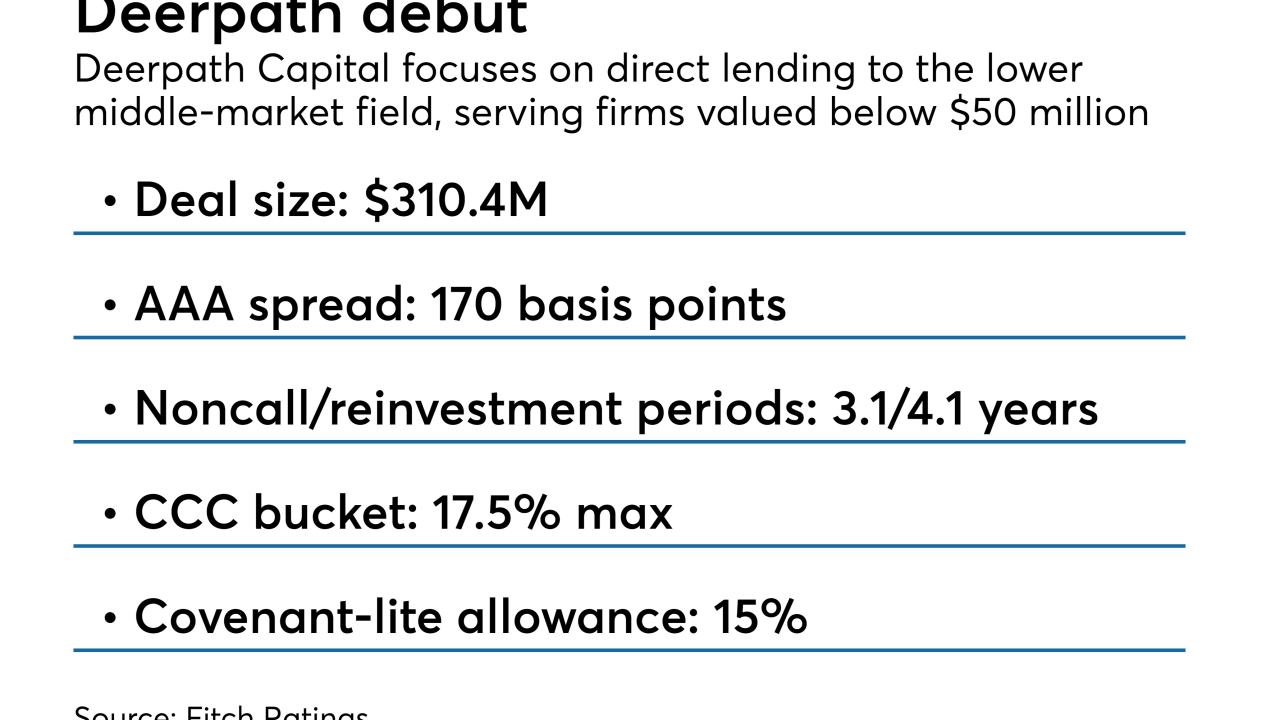

The $308 million Deepath CLO 2018-1 has an unusually large allowance for riskier triple-C loans of up to 17.5% of the portfolio.

December 11 -

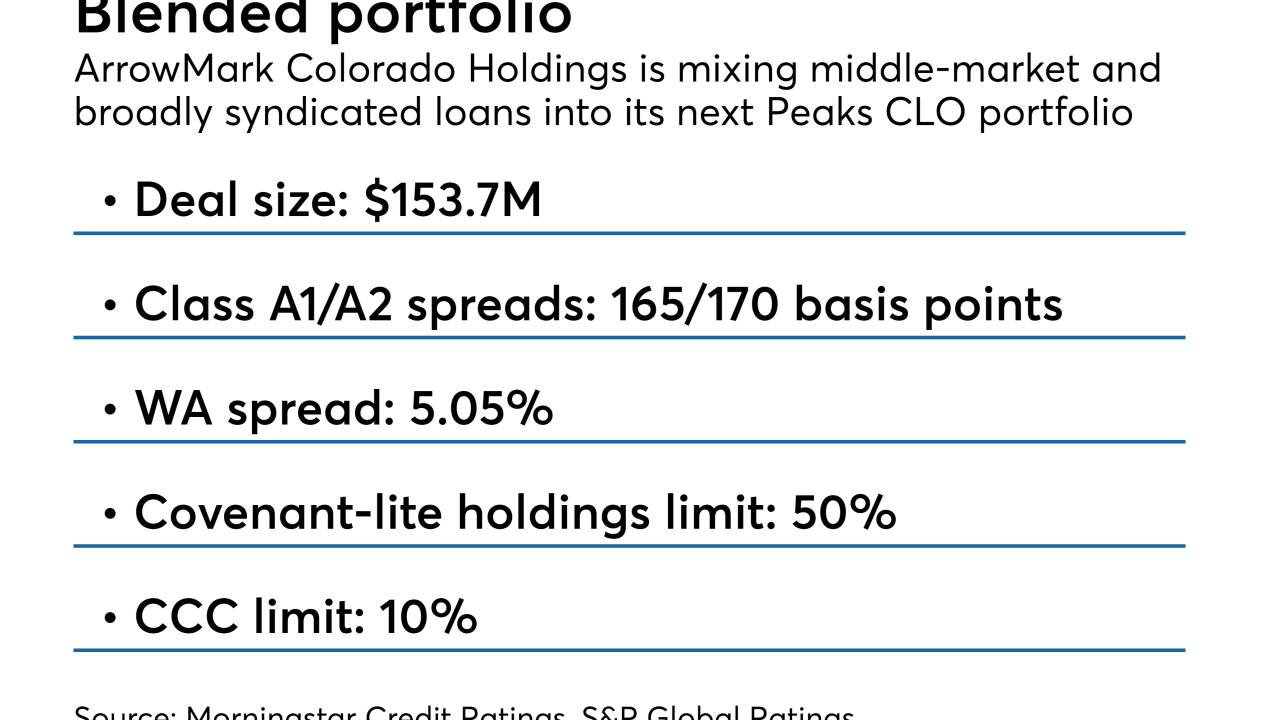

The $153.7 million Peaks CLO 3 also features a high ceiling for triple-C-rated loans and for "current-pay" loans that meet one or more criteria for default.

December 10 -

FORT CRE 2018-1 will include four loans recycled from the prior deal, including one that Kroll has identified as a loan of concern due to weak operating performance.

December 5 -

The sponsor appears to be paying for the privilege; the deal is structured with a super senior tranche of notes that benefits from considerably more subordination than the senior tranche of its prior deal.

December 4 -

Both managers are pricing their 3rd CLOs of 2018; the 135 basis point spread on Zais' is among the widest this year for a deal backed by broadly syndicated loans.

November 27 -

The pool includes loans for 23 new construction, converted or acquired assets, each in a pre-stabilization phase awaiting refinancing through a permanent agency takeout loan.

November 21 -

Guggenheim joins GSO/Blackstone and Bain Capital as longtime CLO managers expanding into the SME space this year.

November 21 -

We are one year deeper into an already extended credit cycle, so it’s even more important to focus on market complacency.

November 20 Fitch Ratings

Fitch Ratings -

More collateralized loan obligations are failing weighted-average lift tests due to the dearth of available loans whose near-term maturities could provide some relief to portfolios.

November 20 -

Kroll assigned an AA+ to the Class A-1 tranche of EJF’s $351 million TruPS transaction, up two notches from AA- on the sponsor's prior transaction.

November 16