-

Natalya Michaels, recently of Artisan Partners, will be a managing director with a focus on marketing, investor relations as well as expanding the firm's investor and product base.

September 25 -

Collateralized loan obligations in Europe are running low on fuel, prompting some investors to seek greater protection that may slow the market even further.

September 20 -

Ratings agencies have argued recently that the population of loans whose ratings fall below the lowest single-B rating – the lowest rung above the highly speculative triple-C ratings layers – will grow significantly in an economic downturn.

September 18 -

Modifiable and splittable/combinable tranches are part of a new feature emerging in the CLO market which is intended to partially set off the negative impact to holders of CLO debt associated with the call feature.

September 16

-

CBAM Partners announced the hiring away from AXA Investment Managers an executive with significant experience in the CLO and European debt markets to assist in the launch of its European credit strategies business.

September 12 -

Managers appear to be increasingly safeguarding portfolios from a potential downturn by dumping distressed assets.

September 6 -

EJF Capital is launching its seventh securitization of subordinated bank debt, via a CDO vehicle that allows smaller banks to raise capital more cheaply and efficiently for regulatory purposes.

August 23 -

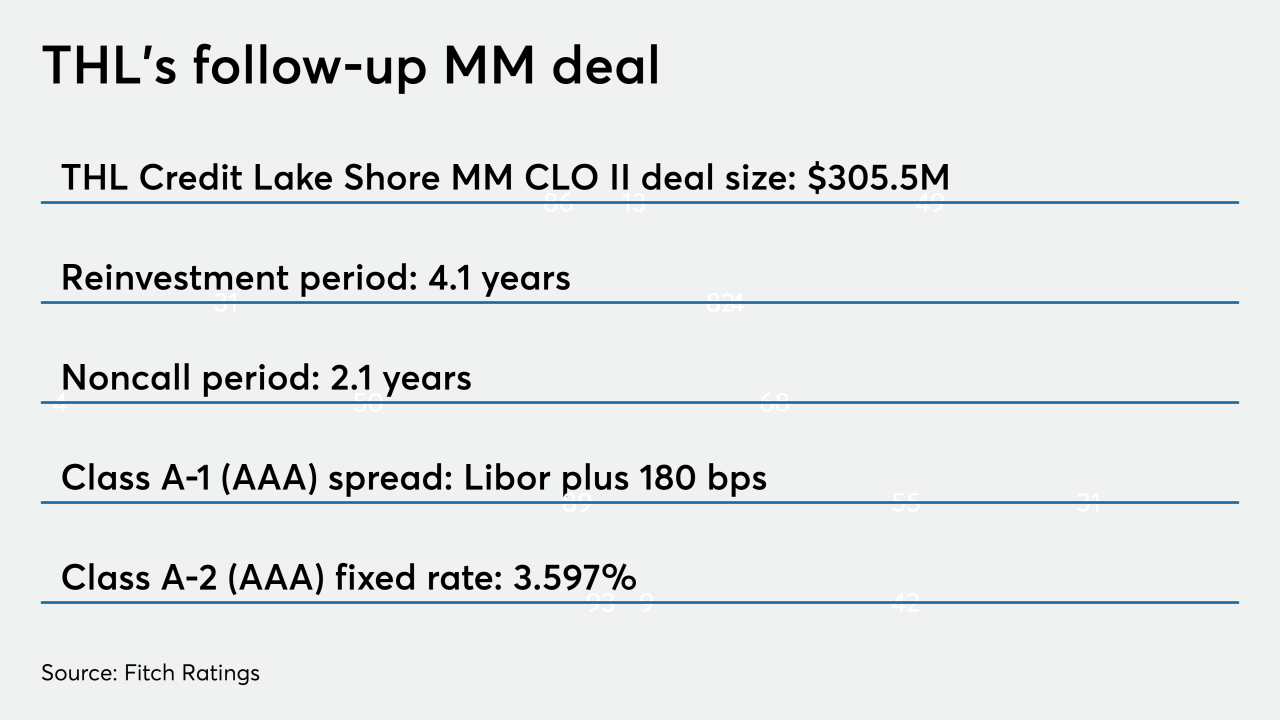

The manager will have four years to actively buy and trade loan assets in THL Credit Lake Shore MM CLO II, compared to two in THL's debut deal from March.

August 21 -

The $435.5 million Crown Point CLO 8 is a broadly syndicated collateralized loan obligation that has a “significantly below average” WARF of 2678, indicating a portfolio with a greater share of safer leveraged loans than other CLOs.

August 13 -

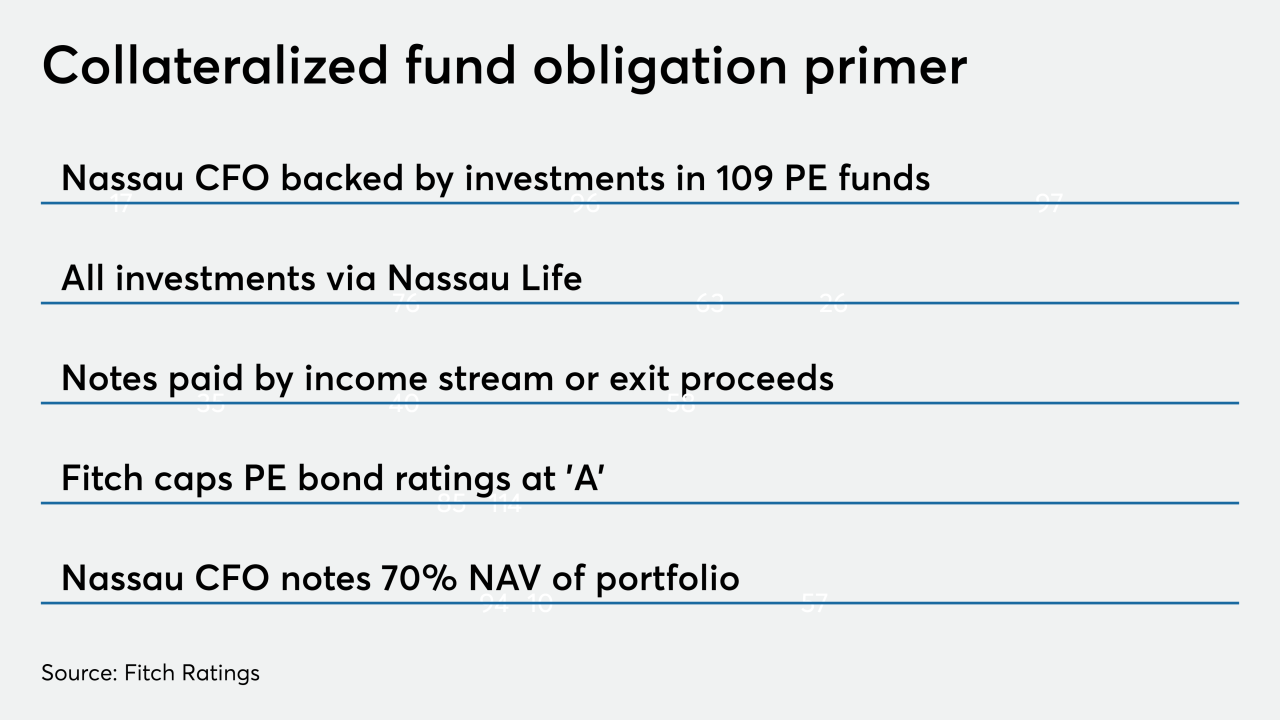

Nassau Financial Group is following the lead of a Singapore sovereign wealth fund into the fledgling asset-backed securities class of private-equity bonds.

August 12