Editor’s note: This is based on an upcoming Moody’s Analytics report about Fannie Mae and Freddie Mac credit risk transfers.

Questions about what do with Fannie Mae and Freddie Mac and what our future housing finance system will look like have plagued policymakers since the two mortgage behemoths were put into conservatorship nearly nine years ago.

But in the background of this debate is an unheralded success story that goes a long way to settling it: credit risk transfers. Risk transfers are not only an effective method for mitigating the risk that Fannie and Freddie pose to taxpayers while in conservatorship, they

To understand credit risk transfers, consider that at their core Fannie and Freddie’s job is to separate the interest rate risk and credit risk inherent in the mortgage loans they purchase. The agencies sell the interest rate risk to investors in mortgage-backed securities, and before the financial crisis they held on to the credit risk. Of course, that’s what got them into trouble. As homeowners stopped making their loan payments, the credit losses overwhelmed what little capital the agencies had, and they failed.

This is where credit risk transfers come in. The transfers began more than four years ago at the behest of the agencies’ regulator, the Federal Housing Finance Agency. Instead of holding on to credit risk, Fannie and Freddie are now transferring much of it to private investors.

The bulk of these risk transfers are through capital market transactions with an array of investors, including asset managers, hedge funds and sovereign wealth funds that agree to buy securities backed by the agencies’ loans that are subject to write-downs if homebuyers default. The risk transfers have expanded more recently to include transactions with other financial institutions, including reinsurers, private mortgage insurers and mortgage lenders. Instead of credit risk remaining at the agencies, making them too big to fail, it is being dispersed broadly throughout the entire global financial system.

To date, Fannie and Freddie have transferred most of the credit risk on $1.6 trillion in mortgage loans — one-third of the loans they own — to private investors. On their more recent loans, the agencies have been transferring more than one-half of the risk, and the transfers are taking place mostly on loans that pose the biggest concern for taxpayers.

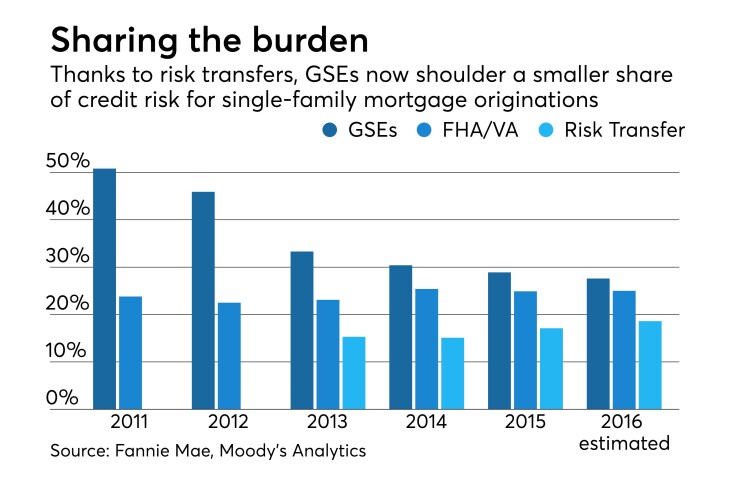

To put the progress into context, consider that private investors in the risk transfers are taking on what is approaching one-fifth of the credit risk in all single-family residential mortgage loans originated in recent years. This is more than private mortgage insurers, and on par with the risk being shouldered by commercial banks and other depository institutions, and the agencies themselves. Only the Federal Housing Administration and Veterans Administration are taking on more risk.

The risk transfers aren’t without controversy. Some are concerned that they won’t protect the agencies and taxpayers when the economy stumbles badly. These are complicated transactions, and how well they transfer risk from the agencies to investors depends on many factors that are uncertain, including the timing of mortgage prepayments and defaults. So it is important to ask whether these transactions will work out as expected, with private investors shouldering a significant amount of any losses on the agencies’ loans when unemployment is high and rising and house prices are falling. From the evidence so far, the answer is yes.

To determine this, consider what would happen if the nation suffered another financial crisis and Great Recession like the one that put Fannie and Freddie into conservatorship. In that severe downturn, the agencies suffered large losses on their mortgage loans and securities, which completely overwhelmed the small amount of capital they held.

If a similarly severe downturn occurred today, the agencies would suffer smaller losses given that the mortgage loans and securities they own are of much higher quality. But more important, because of the capital market risk transfers now in place, approximately two-thirds of the losses would be borne by private investors, not Fannie and Freddie. And given how much capital the agencies would be holding if they were private institutions, they would avoid insolvency and another government takeover.

The risk transfers appear so successful in protecting Fannie and Freddie from losses in bad times, they would provide the agencies with a significant amount of capital if they were private institutions. How much? Based on very stressful scenarios, which include unfavorable assumptions regarding both the timing of prepayments, which are assumed to occur soon after the issuance of the risk transfer, and the timing of defaults, which are assumed to occur much later, the current risk transfers would cover a prodigious more than half the agencies’ capital needs.

Another potential issue with the risk transfers is that the agencies may be overpaying investors to take on credit risk — paying investors more than their own costs of shouldering the risk. If so, then the risk actually being transferred to private investors is less than meets the eye. To assess this, we calculated the interest cost to the agencies of paying investors in their transactions at issuance, and compared this to the agencies’ own cost of bearing the risk. It turns out they are roughly the same; there is thus no indication that Fannie and Freddie are overpaying to transfer risk.

To be sure, if the credit risk transfer process is to provide a stable source of capital through the entire economic cycle, it will need to evolve and expand. Financial markets are volatile and there will be times when capital market investors are unwilling to provide capital, at least not at an exorbitant price. Reinsurers, private mortgage insurers and REITs have a bigger role to play, as they have access to plenty of capital and are willing to take credit risk in less favorable market conditions. They just need to be as financially strong as the agencies and have the same obligations to serve the mortgage market.

While Fannie and Freddie’s credit risk transfers are still in their infancy, they are already succeeding in pushing off considerable amounts of credit risk to private investors, reducing the threat the agencies pose to taxpayers in the current housing finance system, and offering a solid foundation on which to build a new one.