Investors in hundreds of millions of dollars of bonds backed by private student debt could pay the price for shoddy paperwork and aggressive pursuit of troubled borrowers.

Tens of thousands of people who took out loans that now collateralize 15 National Collegiate Student Loan Trusts are having their debts wiped away because the trusts are unable to prove that they own the loans.

As described in

Collectively, the 15 trusts hold 800,000 private student loans totaling $12 billion. More than $5 billion of that debt is in default, the New York Times reports.

Things are getting better for borrowers, and worse for ABS investors. National Collegiate’s lawyers warned in a legal filing last year that word is spreading that the trusts cannot produce the documents needed to foreclose on loans. And this is increasing the likelihood of defaults.

As a result, some of the riskier securities issued by NCSLT between 2003 and 2007 could fail to pay off, according to Moody’s Investors Service. These securities, originally rated between Aaa and A3, are repaid after the more senior tranches of notes issued in these deals. As more loans default, there is less collateral remaining to pay them down.

In the worst case scenario, even holders of the least risky securities issued in five of the 12 deals, the NCSLT master trust, along with the NCSLT 2003-1, 2004-1, 2007-3 and 2007-4, could lose money. Those securities were originally rated Aaa but are now rated as low as Caa3. Very little of their original principal has been repaid, and their interest rates are very high.

Even before the lawsuits were filed, the student loan securities were under pressure from rising defaults.

Moody's began downgraded the securities now rated CAa3 as early as 2008.

The rating agency expectations for lifetime cumulative net losses on the deals now ranges from 24% to 45%, though much of those losses have already occurred. By comparison, at the time of issuance, its expectations for lifetime cumulative net losses ranged from 6% to 8%.

However investors in the senior securities issued by the remaining 10 trusts have little to worry about, according to Moody’s. They are unlikely to sustain losses, even in the worst case scenario, simply because most of the principal of these bonds has already been repaid. There will almost certainly be enough collateral left to repay the rest.

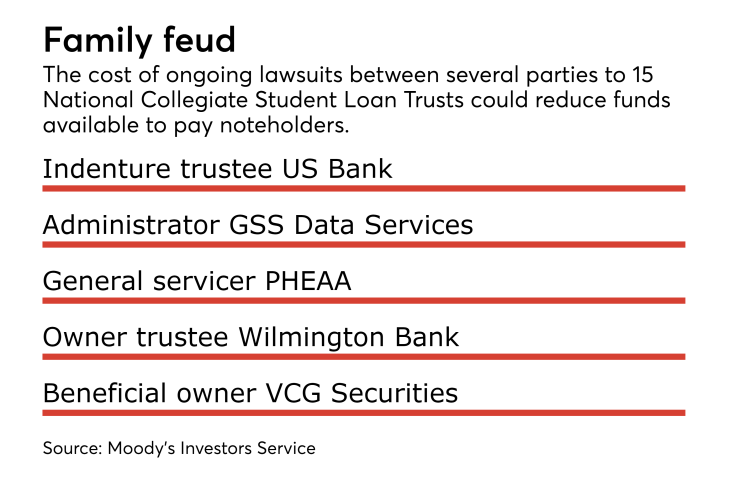

The removal of collateral from the trusts is not the only concern, however. The cost of ongoing lawsuits between the company servicing the loans, Pennsylvania Higher Education Assistance Agency, the indenture trustee, US Bank, and the beneficial owner of the securitizations, VCG Securities, could also eat into funds available to pay bondholders.

The trusts must reimburse the servicer for reasonable expenses, such as attorney’s fees, that relate to their duties. This lowers the amount of cash available to pay noteholders.

Moreover, these lawsuits could result in the servicing transfers, which could negatively impact bondholders if the new servicer lacks sufficient experience or infrastructure to collect and record borrower payments and negotiate workouts.