After the financial crisis, Turkish banks found that they could continue to securitize diversified payment rights (DPRs) without the by-then worthless insurance wraps. Some banks have also found that they can also do without arrangers from abroad.

A case in point is active issuer Garanti Bank. In early April, it self-led and privately issued a 2014-A series of DPR program for $550 million.

A source close to the transaction said this would bring the program to $3.4 billion. Garanti’s last DPR deal, 2013-E, was for $1.1 billion and came out in December. That deal was also self-led.

That's not unsual. Andreas Wilgen, managing director at Fitch Ratings, said that about half of the Turkish DPR bonds in the last few years have been self-led. Many have also been done privately.

“If you’re not widely syndicating and are selling to a small core group of investors,” an arranger isn’t necessary, Wilgen said.

DPRs are linked to electronic money flows from abroad. They are rights to payment orders in a dollars, euros or pounds, in which the ultimate beneficiary is a firm or person holding an account at a bank.

Having performed extraordinarily well throughout the crisis, the DPR sector has some stalwart fans among buysiders who know the asset class well. Turkish banks had used wraps for the massive volumes issued in DPR bonds between 2004 and 2007. But when the ratings of the monolines plummeted during the crisis, the wraps become worthless for the DPR bonds, which were generally in the triple-B category (before being insured). This prompted the banks to de-wrap their deals, which often entailed an originator and investors agreeing to split the premium that would have gone to the monoline.

Throughout this period, the deals performed well.

Now, Turkish banks have the confidence to arrange deals by themselves.

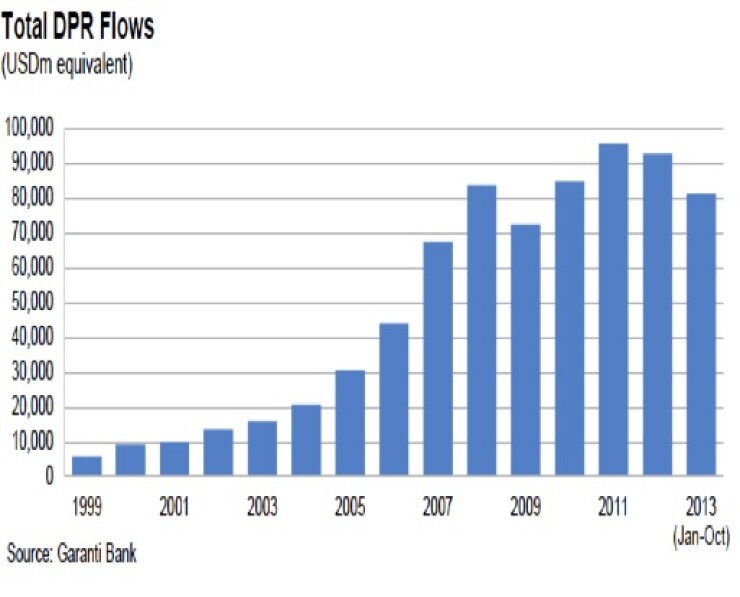

In Guaranti's case, export payments account for a majority of flows, but remittances from Turkish workers abroad are also an engine. These payments have increased significantly for Garanti since the turn of the century.

Fitch assigned an 'A' rating to both the 2014-A and 2013-E deals. While Moody’s Investors Service and Standard & Poor’s did not rate the most recent deal, they do rate outstanding transactions off the same program. Those ratings remain Baa2’ and BBB+’, according to the source close to the transaction.

From Fitch’s perspective, “the most significant variables affecting the rating of the transaction are the credit quality of the bank, its GCA [going concern assessment] score, and the sovereign rating,” accordng to its presale report.

Sovereign risk covers such potentially harmful events such as transfer and convertibility, devaluations, and nationalization and expropriation.

Fitch rates the originator BBB’ and Turkey BBB-.’

The source familiar with Guaranti's most recent deal said that political conflict in Turkey has not made an impact on the bank’s DPR program. Fitch said some degree of political instability is already folded into Turkey’s rating.

Noel Edison, head of insurance and financial services at the European Bank for Reconstruction and Development, said that while the political noise has affected bond prices in Turkey more for senior unsecured bonds than DPR notes — the banks that issue bonds backed by DPRs are typically viewed as having systemic importance and therefore vital to the functioning of the economy.

“We’ve been an active participant in supporting these programs,” said Edison, who added that the bank has invested in a number of recent deals. Typically when the EBRD invests in DPR notes it requires that an amount equal to proceeds from the EBRD investment is to be used for certain purposes, for instance, in lending to small and medium sized companies or projects promoting energy efficiency.

The country's economy has been facing challenges with the devaluation of the lira, down about 15% from a year ago. But as exports should benefit from a weaker lira, this could actually help boost DPR flows.

At any rate, DPR funding remains undoubtedly attractive to Turkish banks - seven deals are rumored to be in the pipeline.

“The alternative for the larger Turkish banks is five-year Eurobonds,” Edison said. “DPRs with the higher investment grade rating represent term funding at attractive pricing.”