Santander Consumer USA’s (NYSE:SC) belief that it could boost deep subprime auto lending without stressing loss rates is starting to pay off.

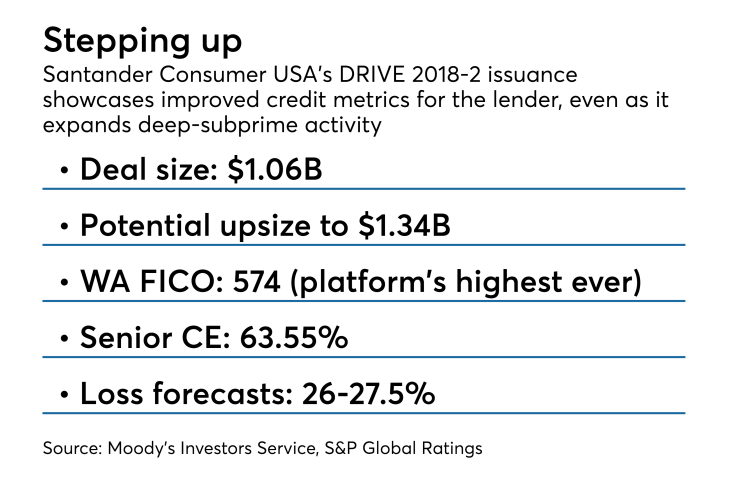

The lender was able to lower the level of investor protections on its latest offering from the Drive Auto Receivables Trust (DRIVE) platform while maintaining triple-A ratings from both Moody’s Investors Service and S&P Global Ratings. The senior notes of the latest transaction, 2018-2, benefit from just initial "hard" credit enhancement of 63.55%, down from 65.25% on the comparable tranche of the previous deal, issued in February.

Chalk it up to lower net charge-offs, fewer losses in outstanding securitizations and rising borrower credit scores.

The deal, launched Thursday, comes just weeks after Santander reported lower net charge-off rates (8.3%) as it grew first-quarter originations by 18.8% to $6.3 billion (which included captive-finance, prime auto loans in its Chrysler Capital joint venture with Chrysler Group LLC). S&P has also lowered its projected losses on recent DRIVE securitizations, which have been performing better than expected.

The same can be said for Santander’s near-prime securitization shelf, which in two deals this year has

This is Santander’s 14th securitization of deeper subprime loans, and the fifth on its DRIVE platform that was created to split off the riskier loans from SDART that sells bonds backed by Santander’s prime and near-prime auto-loan originations with higher average FICOs (610 in SDART 2018-2) and lower APRs (15.75%).

The DRIVE 2018-2 deal is being proposed with two pool-size options of $1.06 billion of $1.34 billion.

The capital stack includes a split fixed-floating rate tranche of senior two-year notes totaling $257 million, or 20.06% of the proposed $1.06 billion pool. The senior tranches also include three-year Class A-3 notes totaling $100.82 million, as well as a money-market tranche (rated P-1 by Moody’s, A-1+ by S&P) totaling $122 million.

If the deal is upsized, the split senior tranche will be boosted to $327 million, the Class A-3 to $126.8 million and the one-year notes to $155 million.

SG Americas is the lead underwriter.

Both pools have a weighted average FICO of 574, a slight uptick from 572 in the first DRIVE transaction of the year and the highest among recent DRIVE deals that had average FICOs as low as 552 last year, according to Moody’s.

For DRIVE 2018-2, S&P is maintaining 26.5%-27.5% expected loss levels similar to Santander's prior deep-subprime ABS, while Moody’s retains a 26% loss forecast in its assessment of Santander’s new DRIVE transaction.

The smaller proposed pool will include 66,440 contracts, while the larger pool would include 84,218. Neither size option would impact the average term (71 months) or loan-to-value ratio average (108%); each carries nearly the same average APRs (18.97% for the $1.06 billion pool, 18.95% for the $1.34 billion notes balance) and average account balance ($19,284 vs. $19,301). Both pools also carry the same mix of new (34%) and used (66%) vehicles, as well.

The loans in the DRIVE 2018-2 pool are primarily unseasoned (average one-month payment), so the improved metrics have borne out Santander’s confidence last fall when it announced it was again revving up originations in the subprime sector as many other lenders were pulling back due to concerns of falling used-car prices affecting recovery and loss rates.

Santander previously pulled back on riskier originations in the midst of a management transition