Conn’s high levels of in-house loan delinquencies continue to plague the Texas-based furniture and appliance store chain.

Fitch Ratings and Kroll Bond Rating Agency are each enforcing a triple-B ratings cap on the senior notes of its newly launched $572 million Conn’s Receivables Funding 2017-B deal, the second asset-backed transaction this year for Conn’s.

Fitch said the cap was in place “(d)ue to higher loan defaults in recent years, management changes at Conn’s, high concentration of receivables from Texas and Conn’s credit risk profile” of a high debt-to-equity ratio (2.54x) from $1.3 billion in outstanding obligations.

In Conn’s 2016 securitizations, for example, those two deals approached or exceeded 15% default rates on collateral pools within a year, according to Fitch.

Loans originated from 2010-2012 only neared 10% default ratings after four years.

Because of the rising delinquencies, the company tightened its risk tolerance beginning in 2016, including discontinuing its no-interest promotional loans on retail installment contracts, for example, instead assigning those duties to partnering creditor (Synchrony).

The percentage of non-promotional loans is up to 63.5% from 58.5% earlier this year, and only 51.5% in its

The company now depends more on direct loans to customers who don’t qualify for Synchrony’s private-label credit offering, which in increasing the APR and excess yield from the five prior Conn’s ABS deals since 2015.

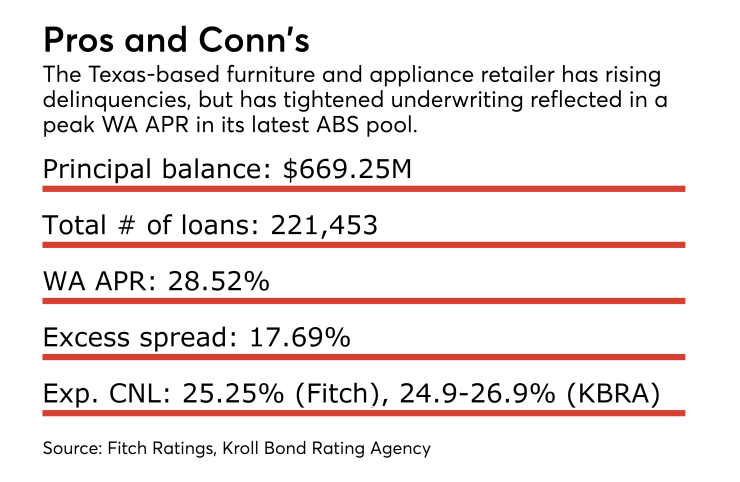

More than 72% of the loans in the $669 million portfolio of loan receivables are from the high-interest direct loan program (compared to 50.86% in Conn’s 2017-A deal), with a weighted average interest rate of 28.94%. (The pool’s receivables include proceeds from repair service agreements and credit-insurance products, as well.)

With fewer deferred-interest, cash-option loans that , the transaction should benefit more from the potential excess spread of 17.69% as more buyers pay the fully due interest on the loans.

The higher rates mitigate the lower initial (14.5%) and target overcollateralization levels that the Conn’s trust is including.

The $361.4 million Class A tranche is supported by 47.5% credit enhancement. The $132.18 million in Class B notes are rated BB, and a $78.64 million Class C tranche is rated B-.

Fitch is raising its expected cumulative default rate to 25.25%, up from 24.25% in its prior deal this year, based on the worsening performance of loans in the company’s pair of 2016 securitizations. KBRA is providing a base-case cumulative net loss range of 24.9-26.9%.

Conn’s rising default levels stem from its 2013 expansion outside of its home state of Texas (where 66% of the 2017-B loans are still originated), when it “simultaneously raised their risk tolerance for new originations.”

Beginning in 2014, operating margins and net income began to suffer, and the company began a two-year senior management shake-up under President and Chief Executive Norm Miller that brought in new executives — including replacements in the chief financial officer and chief operating officer posts.

There was a “more pronounced” volume of defaults for customers with accounts less than a year old, which Conn’s is looking to rectify in its new deal. Customers who have more than one year’s time on Conn’s book have 48.1% of the loans in the pool, compared to 41.1% for 2016-A ABS deal last year.

Credit Suisse, MUFG Securities, JPMorgan and Deutsche Bank are underwriting the transaction.