Two online lenders, Lending Club and Upstart, went face to face in the securitization market this month with competing offerings of bonds backed by unsecured consumer loans.

The deals earned identical credit ratings from Kroll Bond Rating Agency, despite the fact that the collateral for Upstart’s deal was, by several metrics, less risky. Lending Club had to pay up for the A- on its senior notes by offering additional investor protections.

This appears to have paid off.

Upstart had to offer investors a spread of 125 basis points over Libor on its senior notes. By comparison, Lending Club was able to offer a significantly less - just 110 basis points, according to PeerIQ, which published a report

PeerIQ called this a “milestone,” noting that it is competitive with rates offered by GS Bank on certificates of deposit.

The differences in spread are even more striking for the lower-rated tranches of the respective deals. Upstart’s BBB- rated tranche pays Libor plus 225 basis points, while Lending Club’s BBB rated tranche pays Libor plus 180 basis points.

Moving further down the credit stack, Upstart’s BB- rated notes pay Libor plus 475 basis points, while LendingClub’s BB rated notes pay Libor plus 360 basis points.

So Lending Club did more than just level the playing field. The structure of its deal didn’t just satisfy the rating agency that its deal was no riskier than Upstarts; it apparently convinced investors that the notes were less risky.

Trigger Happy

How did it do this? One answer could be the mix of investor protections.

Bond investors in both deals benefit from the same kinds of credit enhancement, including over-collateralization (the value of the collateral exceeds the value of notes issue), subordination (senior noteholders are first in line to get repaid, reserve accounts, and excess spread (the difference between yield on the collateral and yield on the notes). The difference is one of degree: the senior tranche of Lending Club’s deal benefits from a total of 52.25%, compared with 44.35% for Upstart..

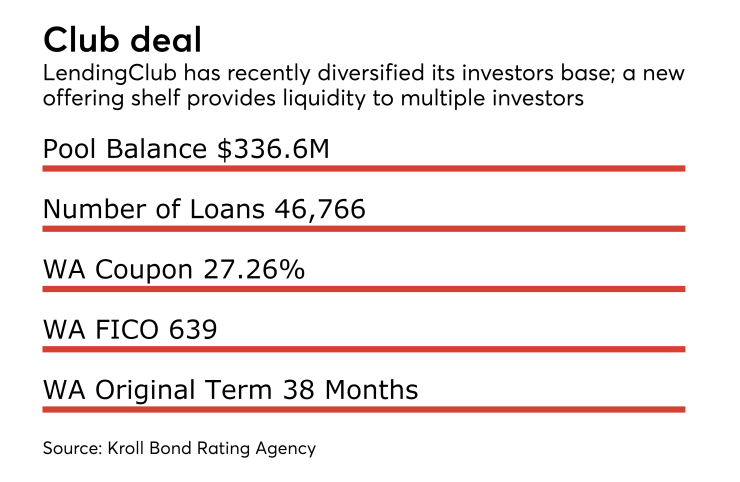

This was necessary because Kroll expects cumulative losses to reach as high as 22% for the loans backing LendingClub’s bonds, compared with just 15% for the Upstart collateral.

Besides credit support, investors in the senior tranches of the two deals also benefit from a feature that accelerates repayment of their principal should the collateral perform worse than expected. There’s give-and-take between the amount of subordination for the senior notes of a deal and the trigger; in general, the higher the subordination, the more comfortable investors in this tranche will be with a less restrictive trigger.

That’s what appears to have happened with CLUB 2017-NP1, which was led by Citigroup and JPMorgan. Holders of the equity, or the riskiest tranche, are providing greater subordination to bond investors. Yet equity holders also benefit from a less restrictive CNL trigger. It starts at 7% and peaks at 29%, which PeerIQ says is the highest starting level of any recent transaction by its peer group of marketplace lenders.

A tighter trigger allows higher potential equity returns in the absence of any collateral losses. So Lending Club is keeping its equity holders happy as well. (Though if losses exceed the available cushion before the triggers are breached, cashflows to the equity investors will be cut off faster and cause a reduction in the expected equity returns, per PeerIQ.)

By contrast, UPST 2017-1, structured and led by Goldman Sachs, has the lowest loss estimate amongst its peers, but also tighter trigger that begins at 4% and peaks at 18%.

Barry Rafferty, Upstart's head of capital markets, pointed to another reason for the difference in pricing: "The A, B, and C notes of Upstart’s deal have longer maturities than comparable tranches of Lending Club’s deal, he said. "Controlling for maturity, our execution was terrific."

Rafferty added that, Upstart achieved higher structural leverage for the equity tranche, 85.5% vs 82.5%. “The A Class was a larger part of the structure, relative to the subordinate bonds.”

Higher Interest Rates

It doesn’t hurt that Lending Club charges much higher interest rates, either. In theory, these rates are in inverse proportion to the risk involved: Lending Club charges higher interest to compensate for the additional likelihood that a particular borrower will default. Until that happens, however there’s a lot more excess spread (extra cash), which benefits both bond investors and equity holders.