In a rare move, Palmer Square Capital Management is refinancing the same collateralized loan obligaiton for a second time this year.

The $420.15 million Palmer Square CLO 2014-1 was originally issued three years ago with a short reinvestment period of a single year, compared with the more typical three to five years.

So when the deal was first refinanced in January, the manager was primarily interested in reviving the then-amoritzing, non-reinvesting deal. In order to do so, it offered investors a higher interest rate, rather than a lower one, The spread on the refinanced senior, triple-A rated notes was set at Libor plus 137 basis points, up from Libor plus 127 basis points originally. (This refinancing did not trigger compliance with risk retention because the deal was already in compliance.)

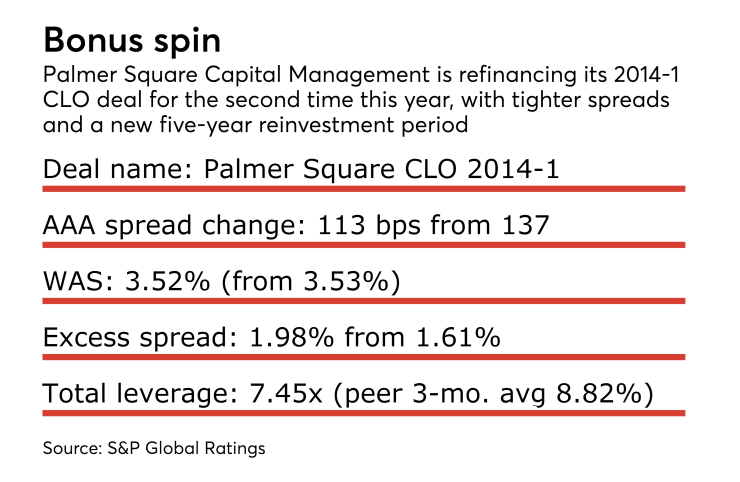

But prevailing spreads on CLO notes have steadily narrowed over the course of this year, making it attractive for the Kansas City, based firm to refinance a second time, both extending the term of the deal and reducing spreads on all four classes of notes. The transaction, slated to close next month, will see the spread on the AAA notes move in to Libor plus 113 basis points.

The deal’s reinvestment period is also being extended to January 2023 from January 2019, and the non-call period is being extended to January 2020 from January 2018.

In a telephone inerview, Palmer Square President Christopher Long said the deal's initial reinvestment period was set at one year because the relatively steep yield curve for CLO notes at the time was attracting a large number of short-term investors who would otherwise be inclined to buy into a refinanced deal.

“We did that back then because we wanted to take advantage of all the excitement around then for refinancings,” he said.

Among other changes, the deal is getting a slightly lower weighted average spread of 3.52% (from 3.53%), a wider excess spread of 1.98% from 1.61% (or the difference of the weighted average spread from the WA cost of debt) and a lighter total leverage of 7.45x – compared to 8.23% previously and the market average of 8.82% over the last three months, according to S&P, which published a presale report on the transaction.

While rare in CLOs, multiple refinancings within a short window have been common in the speculative-grade leveraged loan market, due to ever-shrinking spreads driven by high investor demand. Some companies have even refinanced

So far this year, over $163 billion of CLOs have been refinanced, according to JPMorgan.