Success often comes at a price, and for Laurel Road Bank in Darien, Conn., explosive growth in student loan refinancing has put a strain on its capital ratios.

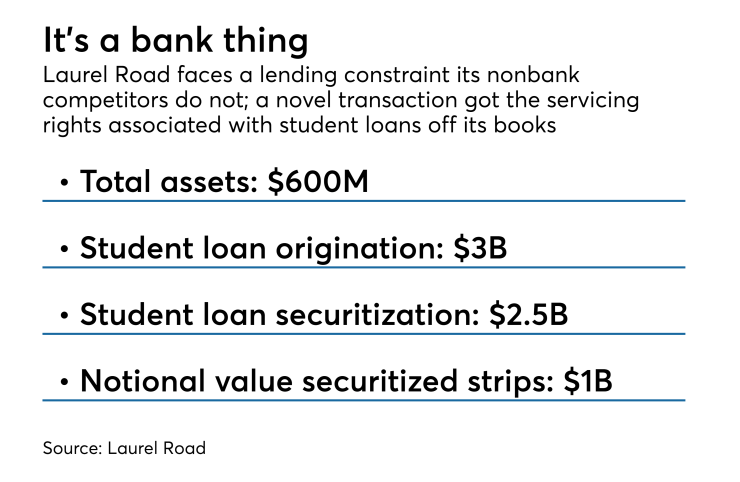

Basel III causes a bank's Tier 1 capital to take a haircut for any servicing rights held on its books. Laurel Road, formerly known as Darien Rowayton Bank, has only $600 million in assets, and over the past five years it has made over $3 billion in private student loans. The loans themselves are an easy sell; Laurel Road has bundled some $2.5 billion into collateral for bonds. It also sells packages of loans to other banks.

The market for excess student loan servicing fees, or what’s left over after collections and payments are outsourced to a subservicer, was nonexistent. So Laurel Road created one. In late March, it closed on a novel transaction securitizing the excess servicing “strips” on student loans. The transaction gets the rights associated with $1 billion of loans off of the bank’s books, reducing the haircut to Tier 1 capital and allowing the bank more capacity to fund loans.

It may be the first securitization of servicing strips on any asset other than mortgages.

“Servicing is very punitive from a capital ratio standpoint,” Gary Lieberman, the bank’s chairman, said in a recent interview. The transaction "does give us the present value of the capital, but that’s not so important to us; it’s really the fact that regulators require us to keep so much capital against servicing … this gets it off of our books.”

Capital ratios are something that Laurel Road’s fintech competitors, which include Social Finance, CommonBond and Earnest (now part of the student loan servicing behemoth Navient), don’t have to worry about — at least not yet. SoFi, which has made some $14 billion in student loans, has explored becoming a bank in the past.

Lieberman said that getting both banking regulators and rating agencies comfortable with the transaction was a lot of work. (DBRS assigned a low investment grade rating of BBB to the single tranche of certificates issued in the transaction.) Finding investors was not so difficult, however. “Clearly there is an interest from a variety of parties,” he said. “It’s a very good asset.”

While many fintech lenders have had to hire capital markets expertise as their

Lieberman says he looked at refinancing student loans while at Merrill, but the arbitrage didn’t work. At the time, long-term interest rates were lower than short-term interest rates, making it uneconomical to fund lending in the capital markets.

After the financial crisis, the yield curve steepened, and with interest rates on federal student loans pegged to the 10-year Treasury rate, it was more attractive to raise money shorter term and use it to fund refinance loans, which tend to pay off in four or five years. Still, Lieberman did not immediately focus on student loans after leading an investor group that purchased and recapitalized Darien Rowayton in 2010; he wanted to wait until regulators developed a

“The risk profile is pretty amazing,” the chairman said. “We’ve done over $3.5 billion in loans, and probably have $1 million in defaults.”

Like other refinance lenders, Laurel Bank wants to expand the range of products it offers to high-earning millennials. On March 28, it launched a digital mortgage. “There’s a correlation between refinance student loans and buying a first home,” Lieberman said. “It’s a natural extension to offer them to our student loan borrower base.”

Within two years, he predicts, mortgage origination will surpass student loans.

Laurel Road also offers consumer loans, though it is approaching this product more conservatively. And later this year it will launch an online platform for raising deposits.

While many brick-and-mortar banks are creating