Invitation Homes is taking advantage of strong demand to launch what could be the biggest offering to date of bonds backed by a portfolio of single-family rental homes.

The transaction, Invitation Homes 2018-SFR3, recycles collateral from three transactions that were completed in 2013, 2014 and 2015 — two of which have since been repaid. In the process, Invitation Homes, which is controlled by the Blackstone Group, is cashing out some $142 million of equity built up in the homes, largely due to rising home prices. The new bonds to be issued will be backed by a single, $1.1 billion floating-rate loan from Deutsche Bank that is secured by mortgages on 5,531 income-producing single-family homes.

Previously, the homes were encumbered by just $958 million of debt.

However, the securitization may be upsized to $1.3 billion prior to pricing, based on investor demand; it would then be the largest single-family rental deal to date, according to Kroll Bond Rating Agency. In this event, an additional 1,131 homes could be added to the collateral, for a total of 6,662.

Even with the additional debt load, the loan-to-value ratio of the 5,531-home portfolio would be just 70% — lower than the prior securitizations, which had LTVs ranging from 78.9% to 75%, primarily due to value appreciation of the underlying collateral. Similarly, the LTV based on KBRA’s adjusted broker price opinion value for the properties is lower at 78.4%, compared with 88.6%, 84% and 85.4% for the previous transactions.

KBRA did not provide comparable LTVs for the larger portfolio in the event the transaction is upsized, though it did say that the larger pool of properties has credit characteristics consistent with the smaller portfolio.

On average, the subject deal consists of properties that have older build dates, but in-line square footage of relative to the comparative set of 25 deals rated by Kroll since 2015. The underlying homes have an average age of 29 years, versus 23 years for the comparative set, while the average square footage of 1,839 is comparable to the average size of 1,830 for the homes in the comparative set. “All else being equal, KBRA generally views older, smaller properties as being less marketable than newer, larger homes in the event of a default and subsequent liquidation,” the presale report states.

The smaller portfolio has a vacancy rate of 2.9% vacant properties, while 31 tenants (0.4%) are delinquent on their rent. As a comparison, 21 of the 25 securitizations issued since January 2015 had vacancy rates at securitization ranging from 0.5% to 6.5%. Issuance delinquency rates for those deals have been less than 2.6% and averaged 0.6%.

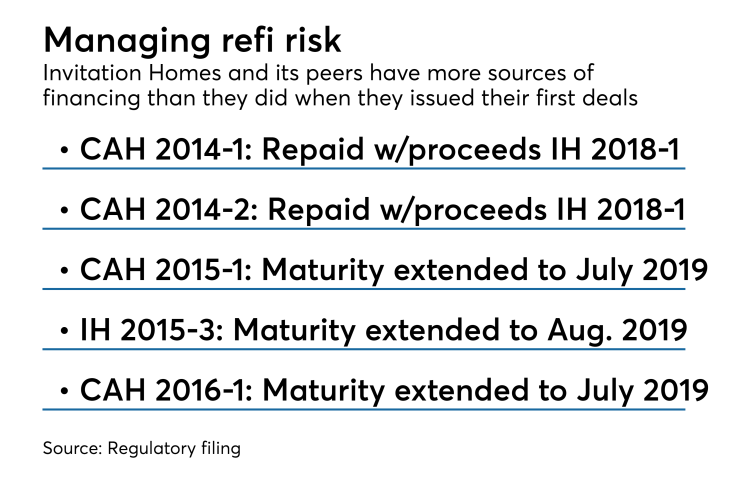

Invitation Homes and its peers have more sources of financing than they did when they completed their earliest securitizations in 2013 , 2014 and 2015, including bank loans, bonds and financing from government-sponsored enterprises. Sponsors also have the option to manage the maturities of their debt by extending the terms of securitizations. The floating-rate loan that will back IH 2018-SFR3 has an initial term of two years but can be extended for 12 months up to five times, for a total extended term of seven years. It pays only interest, and no principal, for its entire term.

Like many recent single-family rental transactions, the deal permits the voluntary substitution of up to 5% of the underlying homes, by property count.