Flagstar Bank, one of the nation’s largest mortgage lenders, is launching its first offering of private-label residential mortgage bonds since the financial crisis.

Unlike the $15 billion-asset bank’s legacy mortgage bonds, the new offering is backed by loans to borrowers with strong credit and significant equity in their homes.

The $443.8 million transaction, FSMT 2017-1, is collateralized by a pool of 668 jumbo prime (75%) and high-balance conforming (25%) loans that Flagstar originated through its retail, broker and correspondent channels, according to rating agency presale reports.

Fitch Ratings, Kroll Bond Rating Agency and DBRS all expect to assign triple-A ratings to the most senior tranches to be issued by the trust, which benefit from 12% credit enhancement.

JPMorgan Securities and Wells Fargo Securities are the initial purchasers.

Flagstar, headquartered in Michigan, is one of several new entrants attracted by the strong market for private-label mortgage bonds of all stripes this year. Most recently, American International Group completed its inaugural offering of prime jumbo mortgage bonds in June.

While Flagstar is still operating under a consent order from the Consumer Financial Protection Bureau related to servicing of troubled loans it originated pre-crisis, all three rating agencies appear to be comfortable with its ability to service prime loans.

Fitch noted in its presale report that Flagstar has made improvements to its risk management policies and procedures since the financial crisis, and that the bank has been originating and contributing to both agency and nonagency securitizations for a number of years.

The attributes of the loans backing Flagstar’s inaugural deal are broadly consistent with those of other recent prime jumbo RMBS, according to both Fitch Ratings and Kroll Bond Rating Agency. The pool of fully amortizing, 30-year and 15-year loans has a weighted average FICO score of 771 and an original combined loan-to-value ratio of 63.5%.

Like most prime jumbo deals, it has heavy exposure to high-cost areas such as California, which accounts for 59.9% of the collateral. Within California, loans are heavily concentrated in the Los Angeles (27.5%), San Francisco (12.9%) and San Jose (7.1%) core based statistical areas.

And since high-net-worth borrowers often buy very expensive homes using “super jumbo” mortgages, these pools of collateral can be lumpy. FSMT 2017-1 has six loans with a current balance that is above $1.5 million; the largest loan is approximately $1.95 million, which represents about 0.4% of the mortgage pool. That means a single default could have a disproportionate effect on the performance of the deal.

All of the loans backing FSMT 2017-1 meet the criteria for “qualified residential mortgages,” which means Flagstar is exempt from a requirement to keep “skin in the game” of the deal.

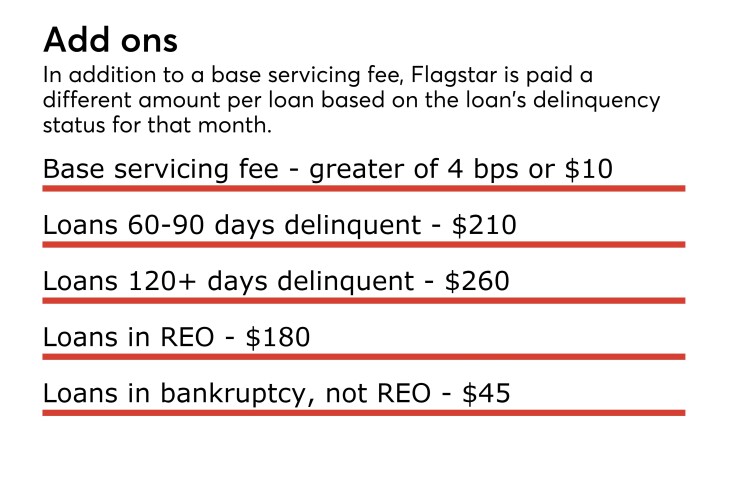

However, both Fitch and Kroll raised concerns in their presale reports about the potential for various fees to eat into the performance of the deal under certain circumstances. Kroll noted that servicing fees Flagstar receives are significantly lower than those of other prime jumbo deal, but will increase as the performance of the deal worsens; by comparison, servicing fees on other prime jumbo deals are fixed.

“In periods of economic stress, the servicing fees realized in any given month could exceed those under a typical fixed servicing fee arrangement,” the presale report states.

Fitch noted that the trust is obligated to reimburse the breach reviewer, Inglet Blair, each month for any reasonable out-of-pocket expenses incurred if the company is requested to participate in any arbitration, legal or regulatory actions, proceedings or hearings; these fees are not capped and not subject to approval by certificate holders.

While Fitch accounted for the potential additional costs by upwardly adjusting its loss estimation for the pool, the rating agency warned that this arrangement could potentially add to ratings volatility.