EJF Capital is preparing another collateralized debt obligation backed by securities intended to help small banks and insurance companies raise capital.

At $537.9 million, TruPS Financials Note Securitization 2018-1 is significantly larger than the $353 million transaction EJF completed in

It is backed by $499.8 million of trust-preferred securities (TruPS) and subordinated debt issued by 63 banks, and $380 million of TruPS and surplus notes issued by four insurance companies or their holding companies. The majority of TruPS and surplus notes were previously held in bank and insurance TruPS CDOs that have redeemed.

The portfolio is static and cannot be called, or redeemed, until March 202.

Typically, TruPS are nonamortizing, preferred stock securities with 30-year maturities and five- or 10-year noncall periods. They can defer interest for up to five years without being considered in default. Surplus notes issued by insurance companies are a highly subordinated form of debt and have characteristics similar to insurance TruPS. All the TruPS and surplus notes in the CDO portfolio are beyond their noncall periods. Subordinated debt is nondeferrable and usually has a 10-year maturity.

The collateral is initially composed of 8,401 contracts, with an average remaining discounted contract balance of $39,654 and a weighted average remaining term of 47 months.

Moody’s Investors Service expects to assign an Aa3 rating to two senior tranches of notes, a floating-rate tranche that pays Libor plus 155 basis points and a tranche that pays a fixed rate of 4.29%. There are also two subordinate tranches, one rated A3 and the other Ba3, and an unrated tranche of preferred shares.

Merrill Lynch, Pierce, Fenner & Smith is the underwriter.

Among the risks to the transaction, according to Moody’s, is the fact that it includes subordinated debt issued by a number of bank holding companies with significant amounts of other debt on their balance sheet which may increase the risk presented by their subsidiaries.

The presale report does not identify these issuers.

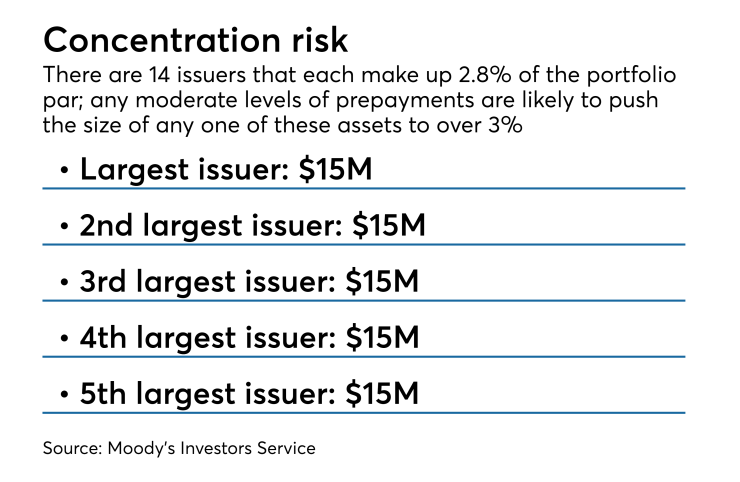

The portfolio is also "modestly" concentrated, according to Moody's It includes 14 issuers that each make up approximately 2.8% of the portfolio par. Any moderate levels of prepayments in the portfolio are likely to push the size of any one of these assets to over 3% relative

to par and hence up to 30% of the portfolio could be subjected to a two-notch downgrade.

The transaction has a legal, final maturity of 2038, but could be repaid sooner. EJF will sell the portfolio and redeem the Class A-1, Class A-2 Class B and Class C Notes if upon the eighth anniversary of the closing date the portfolio can be sold to generate sufficient proceeds to repay the principal and accrued interest on the rated notes in full. If the auction is unsuccessful, the auction will be held annually until successful or until maturity.

In addition to the latest deal, EJF also manages a bank subordinated debt CDO that closed in November 2015, an insurance TruPS CDO that closed in March 2016, and three bank/insurance TruPS CDOs that closed in 2016 and 2017. In addition, the manager also currently manages four pre-2007 real estate investment trust TruPS CDOs.