Driven Brands is returning to the securitization market with its third offering of bonds backed by franchise fees, according to Kroll Bond Rating Agency.

The new, $250 million securitization is the first to include fees associated with the Take 5 Oil Change brand acquired in 2016. Proceeds will be used to repay existing debt and for general corporate purposes, including funding a possible dividend to Driven Brands’ private equity owners, Roark Capital Group.

The new notes, which are being issued from a master trust, will rank on an equal basis with outstanding notes issued in 2016 and 2015.

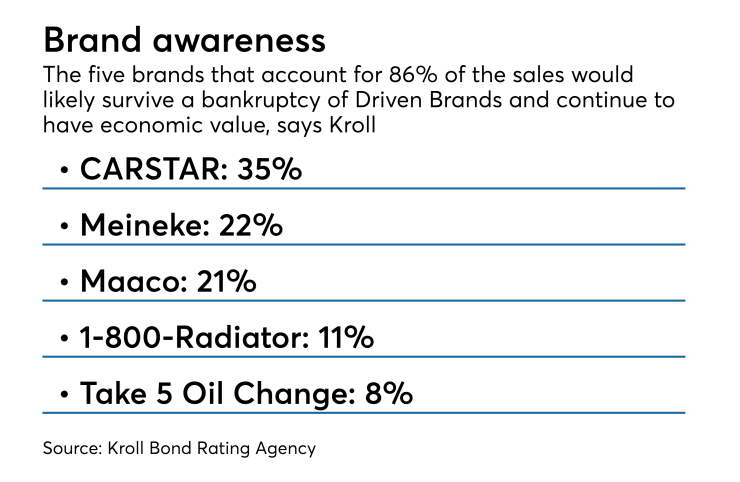

Driven Brands is one of the largest franchisors in the aftermarket automobile services and parts distribution industries; its largest brands include CARSTAR, Maaco, Meineke, and 1-800-Radiator. All told, it has a network of 2,591 locations across 49 states and 10 Canadian provinces. Approximately 89% of the locations are franchises, with an average tenure of over 16 years.

While the 275 Take 5 locations are primarily (271) company-owned, which tend to have more volatile cash flow, Kroll believes that adding their revenues to the trust supports issuance of the additional debt.

“Unlike the other verticals within Driven Brands, Take 5’s company-owned and operated locations may increase the reliance on the company’s operating abilities to achieve higher performance and operating results,” the presale report states. “Further, since the transaction collateral also includes operating profits from company-owned Take 5 locations, there may be additional cash flow volatility given potential for margin compression at those locations.”

Lastly, Take 5 may not enjoy the same level of brand recognition as some of the other larger brands within the Driven Brands family, so its brand value may be more volatile if the company were to experience a bankruptcy event.

The rating agency expects to assign a BBB rating to a single tranche of notes with an expected repayment date of April 2025 and a final maturity of April 2048.

Upon completion of the offering, Driven Brands’ total outstanding debt will rise to $744 million from $502 million. However, cash flow net of securitization fees will be $133 million, up from $79 million at the time of the 2016 securitization, so the company is less highly leveraged, per Kroll. The ratio of total debt to securitized net cash flow will fall, to 5.6 times from 6.4 times.

The addition of Take 5 isn’t the only reason for the growth in securitized net cash flow; there has also been organic growth from existing brands and some slight amortization of outstanding debt.