Investing in collateralized loan obligation securities used to be primarily a “buy and hold” business, says Jay Huang.

The new structured products head at CIFC Asset Management should know; he spent 16 years at Citigroup, were he helped create and operate one of the first CLO/CDO trading desks. In the early days, before the financial crisis, a clients (typically insurance companies) might trade once every two weeks.

Not anymore.

Now a typical trading desk might handle dozens of transactions a day with a wider swathe of investors, including other asset management firms, international buyers and private wealth. This creates opportunities for a firm like CIFC, which both manages CLOs and invests in them to enhance returns. But it is also requiring enhanced risk management to track the rapid changes occurring to underlying loans.

Huang was hired by CIFC in January to bring his structured product trading expertise to bear at the firm. He reports to CIFC’s co-CEOs Oliver Wriedt and Steve Vaccaro. In his new post, Huang says he will be tasked with almost a daily trading, investing and underwriting of the firm’s structured product investment holdings, including third-party CLO mezzanine and debt securities.

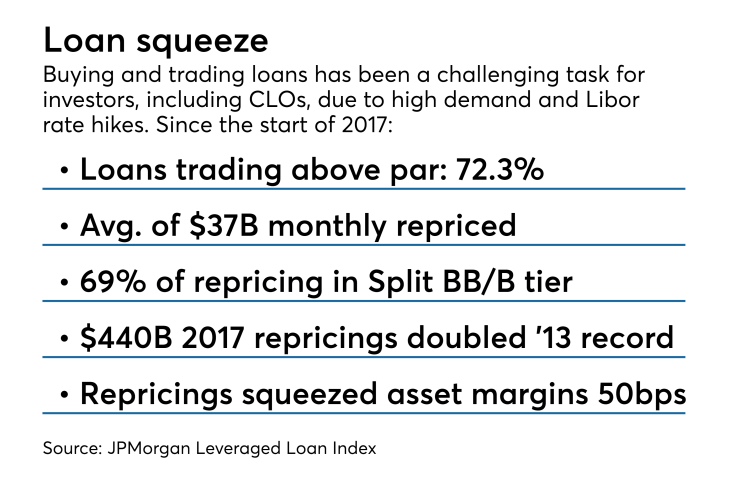

At the moment, that might be a challenging enterprise, given that more than 72% of the loans on the JPMorgan Leveraged Loan Index this week were trading above par, or face value.

But Huang is confident that firm's relationships across the credit and capital markets, combined with a focus on strengthening the trading desk’s technology to analyze the risks and opportunities of individual loans, will keep the growth of CIFC’s buy-side arm on track.

Huang discussed his new role building out CIFC’s trading operations, which focus on mezzanine debt and equity, as well as his views on how the repeal of risk retention will impact the CLO market (the interview took place prior to the Feb. 9 federal court ruling exempting CLOs from the requirement they maintain a 5% stake in the credit risk of their deals).

Discuss your background with Citigroup.

I was with Citi for 16 years. For the last 10 I served as managing director and global head of CLO, CDO and distressed structured investment vehicle (SIV) trading. I managed teams in New York and London, and oversaw trading, risk, distribution and relationships with over 500 global trading counterparties. When I first started out at Citi in 2000, CLOs rarely ever changed hands after issuance; CLOs were, for the most part, known to be buy-and-hold investments. That would change quickly in the next two years.

In 2002, I was part of a two-person team at Citi that launched the firm’s first dedicated CDO/CLO trading business. Back then, there was 1 BWIC [bid wanted in competition] every two weeks (now it is common to see 10-20 in a single day). When I joined Citi in 2000, I spent two years in CLO and CDO structuring. All in all, I spent two years creating the product, and the next 14 trading it.

What will be different with the opportunity at CIFC?

My primary interest has and continues to be proactive value creation in long-term investment portfolios, as opposed to market making. I had always wanted to join a rapidly growing buy-side firm where I can work with a proven, top-tier credit team and integrate their granular credit views on the underlying credits into my structured credit investment framework.

What I plan to bring to CIFC is a trading-oriented value creation strategy in structured products buoyed by the firm’s crown jewel strengths in fundamental credit and capital markets relationships. The marriage of all those dimensions will give us the edge to proactively trade our portfolio and improve our risk profiles constantly. Now, that doesn’t mean we need to trade every day, but I guess you could say that every day we will be looking to re-underwrite our portfolio against the rest of the market.

Has trading become a more important skill set for a CLO manager because of the rising level of refinancings?

Trading has always been an important element of maximizing the value of a portfolio of CLOs, particularly when you have the benefit of detailed credit analytics into the underlying loans. This is even more true today because there are more existing deals in the market than ever before. The flood of outstanding CLOs in the market has never been so large, and it’s constantly growing. Post-crisis, I would estimate secondary trading volumes have been anywhere from five to 10 times what they were pre-crisis. I think that number surprises a lot of people — that’s because the vast majority of CLOs issued pre-crisis were sold into buy-and-hold type levered vehicles/accounts. Nowadays, the account base is much more diverse — mutual funds, insurance companies, banks, pensions, corporate treasuries, family offices, etc.

What changes do you have in mind for CIFC’s CLO business?

At CIFC, I look forward to using my experience in applying data science concepts and creating cutting-edge trading technology to help the firm effectively boost its technology framework. We plan on building an in-house custom analytics system that will integrate external data sources with the firm’s existing credit analytics platform and apply them to CLO investments as well as many other structured products as we continue to expand beyond CLOs. Data science will be a central part of our risk management systems here.

With this greater emphasis on trading, do you plan on increasing deal sizes or raising more funds for third-party CLO investments?

My main effort at CIFC will be further building the infrastructure for and AUM of our structured product investments business. The vast majority of our structured product portfolio is effectively mezzanine debt and equity. Throughout my career, I have actively managed large portfolios, from AAAs all the way down to equity.

If risk retention is ultimately reversed, how do you think it will change deal structures?

For the most part, the market believes there aren’t going to be any problems with a repeal. I believe the risk retention money that has been raised will stay in place and be invested. I do not believe that the market can keep up the issuance pace of 2017 without the risk retention money. I know from my experience as a dealer that the current depth of buyers for majority CLO equity stakes (which is what the market would need to fully replace if risk retention capital went away) is not as deep as most market participants believe. Some potential scenarios (1) more regular-way majority equity buyers enter the market, (2) CLO managers continue to find risk retention-type partners or (3) CLO issuance slows.

Will smaller managers emerge, or will CMVs be spun off or liquidated?

I think most managers, now that they have the option to sell some of their equity from previous deals, will at least explore that post-risk retention appeal. Now, that doesn’t mean there is going to be a flood of equity supply in the market. I would guess most asset managers aren’t in the business of prop trading their own balance sheet; they’re effectively in the fee business. That doesn’t mean there’s going to be a bunch of forced selling, nor does it mean they’re going to sell 100% of what they own. It’s more a matter of optimizing their own asset management balance sheet.

In terms of newer, smaller asset managers, I do expect more to come to market and try to underwrite deals the “regular way,” by going to a dealer and having them place most or all the debt and equity tranches. But, if the current buyer base of the market stays where it is right now, I again don’t think the buyer base for those types of managers is as deep as people think it is.

At CIFC, we will underwrite the smaller, lesser-known managers. There aren’t a lot of funds out there that are in that type of business to underwrite a new manager as opposed to evaluating existing managers with long track records.

Is the sheer volume of deals out there making it more difficult to market or arrange a CLO?

Generally speaking, over the past year cash balances within CLOs have declined. Prudent managers will take the time they need to ramp a solid portfolio as opposed to “buying the market” to fill a CLO or a CLO warehouse. When we invest in managers, we look for those managers who are not in a rush to fill out their entire CLO portfolio right away — managers who will make prudent decisions and take necessary time to buy what’s needed in the CLOs to keep them in good standing over the long term.

What do you make of the trend toward shorter reinvestment and noncall periods in resets and some new deals?

The credit curve for CLO debt was steep enough in the first quarter of 2018 for many more shorter deals to be created. If you were to create a deal that had a three-year reinvestment period, and a one-year noncall, the average spread on the liability stack would be significantly tighter than issuing a five and two (reinvestment/noncall) deal. Many debt investors are willing to take a lower spread, or the shorter noncall, for the shorter-tenor debt.

It’s also beneficial for the equity holders, who are very confident that in the short term, (within one year) there won’t be a ton of credit problems and the credit environment will still be benign. So, they have the option after one year to effectively reset, refinance or liquidate the transaction.

How do you see spread trends developing? Can they get even tighter?

With a large number CLOs waiting to get issued, refinanced or reset post-repeal of risk retention, the supply dynamic is much more likely to push spreads wider in the near term.

A potential driver for CLO spread tightening is rising Libor. Let’s take as an example insurance companies. One of their biggest valuation metrics is the book yield of their investment portfolio, which is driven off current coupon. As Libor increases, so does the current coupon on CLO debt because of their floating-rate nature; as a result, CLOs will look more attractive to insurance companies because of their improved “book yield.”

Some competing products for triple-A CLOs, for instance, CMBS, are still significantly tighter than where CLOs are, so that’s another signal that CLOs have some ways to go in terms of tightening.