With a week remaining in the Small Business Administration's 2023 fiscal year, Bank of America has notched sizable increases in 7(a) loans and loan volume. Steve Turner, the Charlotte, North Carolina-based money center's national SBA executive, is determined to see the momentum carry over into fiscal 2024.

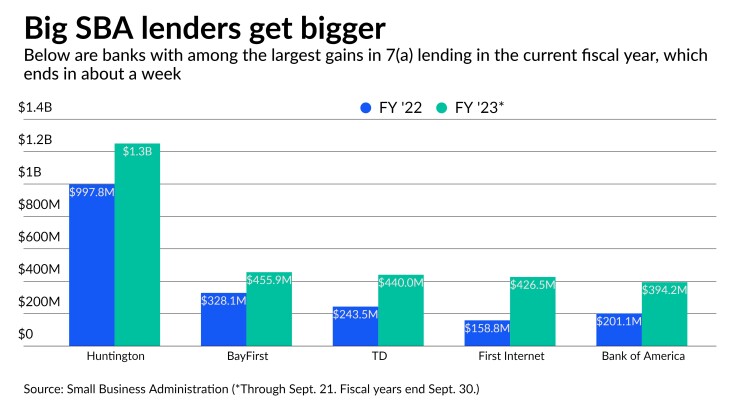

Bank of America has produced 1,000 7(a) loans totaling $394.2 million so far in fiscal 2023, up from 505 loans for $201.1 million in fiscal 2022. For fiscal 2024, which starts Oct. 1, Turner is setting his sights on $1 billion of SBA loan volume, including 7(a) and the agency's smaller 504 loan program.

It's a lofty goal. Though about 1,500 lenders made 7(a) loans in fiscal 2023, only three — Huntington Bancshares, Live Oak Bank and NewtekOne — have reached $1 billion in originations.

"Every day, every week, every month we're continuing to invest in this business to grow it," Turner said in an interview.

Turner, who took over as head of SBA lending in January 2022, said Bank of America has added staff and overhauled its SBA lending process. The most important upgrade may have come from reaching out to the company's thousands of small-business bankers to ensure SBA lending is at the top of their minds. "Educating that army of bankers out there has helped us capture more business," Turner said.

Turner's ultimate goal is for Bank of America to become the nation's largest 7(a) lender. "If we're going to be in SBA, we want to be the best," Turner said. "There's so much more we can do. We don't even have 2% market share."

But the megabank is likely to face stiff competition. Indeed, Huntington Bancshares in Columbus, Ohio, is not standing pat and is poised to retain its title as the No. 1 lender in 7(a) by number of loans for a sixth straight year. Through Sept. 21, Huntington originated a bank-record 6,875 7(a) loans, nearly 3,300 more than its closest rival, TD Bank. Huntington's 7(a) dollar volume also surpassed $1 billion for the first time, at $1.3 billion.

The $10.8 billion-asset Live Oak, based in Wilmington, North Carolina, remains the nation's largest 7(a) lender by dollar volume, with originations totaling $1.7 billion through Sept. 21. The 7(a) program, SBA's flagship, offers guarantees ranging from 50% to 85% on loans originated by participating lenders. Since the end of 2019, SBA has approved more than 195,000 7(a) loans totaling $110 billion. SBA's 504 program provides long-term financing for fixed assets such as building and big-ticket equipment. Current 504 volume is $6.1 billion, according to SBA.

While its branch footprint focuses on the Midwest, the $189 billion-asset Huntington has

"We've taken this exact model on the road," SBA Director Maggie Ference said in an interview. "As we head into [markets] where we don't have that same brand presence, we're still seeing the small-business applicants really take on that entire relationship with us. … We're not simply making loans and moving on."

At the same time, Huntington is investing in technology to accelerate decision making. "In the non-SBA space, where we can move a little faster, we're on a path that in the next 12 months we'll decision 70% of business banking applications in under four hours," Standridge said. "Over the next couple of years, we'll be able to fund those loans the next day, so decision the same day, fund next day."

Huntington is working to extend the same capabilities to SBA lending. "We're making significant investments in the digital space that provide the ease of doing business," Ference said.

"We believe we can continue to improve the cycle time and the customer experience in SBA and stay ahead of the game," Standridge said.

Program-wide, SBA is reporting 53,619 7(a) loans through Sept. 21 for $25.4 billion. The dollar volume is relatively level with fiscal 2022 but total 7(a) loans are up 12%, with much of the added volume being generated by the program's biggest lenders. The dollar-volume share captured by the 10 biggest 7(a) lenders totals 29% so far in fiscal 2023, up from 26% from fiscal 2022. The consolidation trend becomes even starker by number of loans, with the top 10 accounting for 43% of loan volume.

The 7(a) program has been top-heavy for years, despite efforts by SBA to boost participation, James Ballentine, retired executive vice president for congressional relations and political affairs at the American Bankers Association and a former associate deputy administrator at SBA, said in an interview. "It's not unusual in the SBA program that the top 10 or 15 lenders dominate the marketplace both in loan volume and number of loans as well, that's been historical."

"From SBA's perspective, they want as many lenders involved in the program making as many loans as possible," Ballentine added.

In a statement to American Banker, SBA highlighted several areas of "notable progress" as fiscal 2023 comes to an end, including increases in the number of loans under $150,000, as well as loans to Black, Latino and women business owners, though "significant work remains to be done," it added.

In a press release Thursday, Administrator Isabella Casillas Guzman noted Black businesses have received just under 4,400 loans in fiscal 2023, about 7.5% of total loans and double the share from 2017. "Black businesses are helping to power a nationwide small business boom that is creating jobs, advancing equity in communities across America, and uplifting our economy," Guzman said in the press release.

Still, in fiscal 2023, the story has largely been about big, established lenders adding to their 7(a) market shares.

TD in Cherry Hill, New Jersey, the American arm of the Toronto-based TD Bank Group, was able to move into the ranks of the top-10 7(a) lenders in fiscal 2023 from the No. 14 slot in 2022. TD has originated 3,586 loans for $440 million thus far in fiscal 2023 compared to 2,043 loans for $243.5 million in fiscal 2022.

According to Head of SBA Lending Tom Pretty, the $374.3 billion-asset TD has increased the number of small-business specialists on its SBA team. Another primary driver behind TD's 7(a) gains was its decision to increase the threshold for loan scoring by $100,000 to $250,000. "In previous years, we used to score up to $150,000 and underwrite everything after that," Pretty said.

"We've had a lot of success with [the increased scoring threshold]," Pretty said. "It speaks to TD's goals. If we can do the right thing for our colleagues, do the right thing for our communities and do the right thing for our customers, everything else is going to be successful from there. This fits right into the middle of that vein. It makes things simpler for our colleagues, we're able to help more customers, and obviously the more we empower small business the better it is for our communities."

At $122,700, TD's average loan size is among the lowest of any large-scale 7(a) lenders. "We feel it's really important to serve the entire SBA community, not just focus on the big loans," Pretty said. "We feel like by helping with these small loans, getting more specialists, raising the [scoring threshold], it really helps impact our customers and ultimately our communities."

To be sure, not all of the institutions that have produced big 7(a) gains in fiscal 2023 are industry giants on the scale of Bank of America, TD and Huntington. The $1.1 billion-asset BayFirst Financial in St. Petersburg, Florida, has originated 2,526 7(a) loans for $455.9 billion, up from 974 loans and $328.1 million a year ago.

The $4.9 billion-asset First Internet Bancorp in Fishers, Indiana, has doubled both its 7(a) loan originations and dollar volume, recording 327 loans for $426.5 million compared to 158 loans for $158.8 million in fiscal 2022.

According to President and Chief Operating Officer Nicole Lorch, First Internet entered the SBA lending business in November 2019 by acquiring First Colorado National Bank's small-business lending portfolio. A few months later, when the pandemic hit, First Internet made a critical decision to keep its new SBA team focused on their core duties. "We used other commercial lenders to make Paycheck Protection Program loans," Lorch said. "That first year helped us get a foothold in the industry. Over time, we've continued to add tremendous talent to the organization."

While First Internet's current SBA team is keeping up with its current, increased volume, the company will likely add staff as it "leans in" to its SBA strategy, Lorch said. "We will obviously have to add people in servicing, because the portfolio has gotten so big," Lorch said.

"It's been a tremendous four years," Lorch added. "I can confidently say we have exceeded my expectations."