With resources provided through the Homeowner Assistance Fund, the $1 billion plan will help cover homeowners’ past-due payments and comes after New York unveiled a similar assistance package earlier this month.

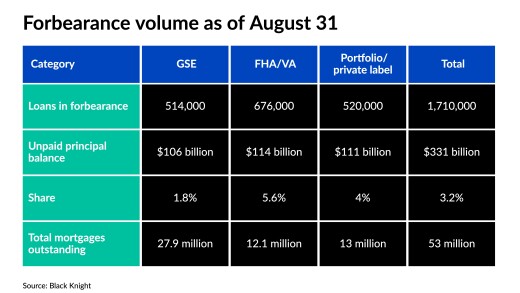

About 400,000 plans are scheduled to drop out in September based on the limits afforded by the CARES Act.

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

High-quality fully amortizing residential mortgages collateralize deal underwritten by Bank of America.

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

By purchasing additional assets and securities, the Federal Reserve provided the financial markets with enough liquidity to weather the pandemic recession. But with the economy starting to recover, it needs to reduce such funding before it creates dangerous bubbles over the long term, say two former bankers.

Credit investors are stepping into a void left by banks and insurance companies and providing debt financing for top-quality hotels in a bet on a post-pandemic recovery, according to a report from the real estate services firm JLL.

In an analysis of the pandemic's impact on the housing market, the agency said nearly 10% of households could be at risk of eviction or foreclosure despite government programs to enable homeowners to delay their payments.

-

With resources provided through the Homeowner Assistance Fund, the $1 billion plan will help cover homeowners’ past-due payments and comes after New York unveiled a similar assistance package earlier this month.

December 21 -

About 400,000 plans are scheduled to drop out in September based on the limits afforded by the CARES Act.

September 3 -

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

July 16 -

High-quality fully amortizing residential mortgages collateralize deal underwritten by Bank of America.

June 1 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

By purchasing additional assets and securities, the Federal Reserve provided the financial markets with enough liquidity to weather the pandemic recession. But with the economy starting to recover, it needs to reduce such funding before it creates dangerous bubbles over the long term, say two former bankers.

March 26 Washington Mutual Bank

Washington Mutual Bank -

Credit investors are stepping into a void left by banks and insurance companies and providing debt financing for top-quality hotels in a bet on a post-pandemic recovery, according to a report from the real estate services firm JLL.

March 4