-

A company official says Ygrene's $280.4 million GoodGreen 2017-2 was more than two times oversubscribed with a lowest-ever coupon for a property assessed clean energy deal.

By Glen FestNovember 16 -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

By Glen FestNovember 15 -

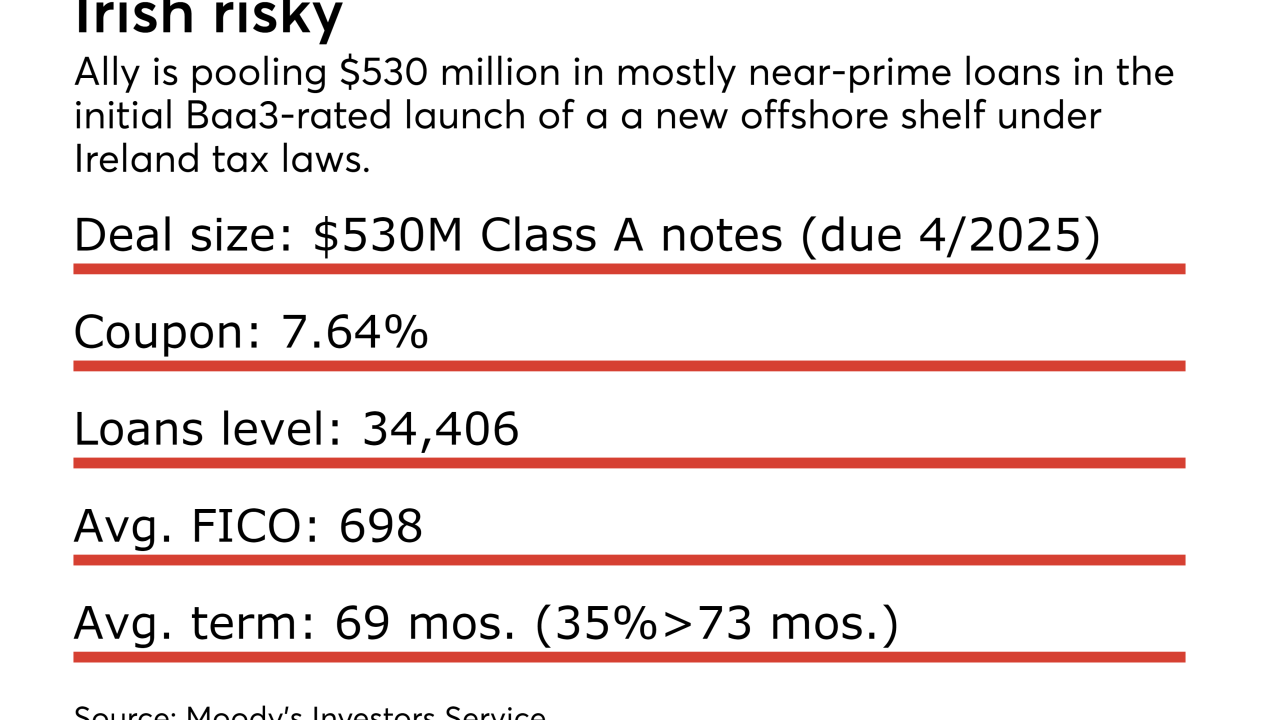

Juniper Receiveables DAC, a new offshore shelf for Ally U.S. auto-loan receivables, has received an early 'Baa3' rating from Moody's Investors Service on its initial $530 million issuance.

By Glen FestNovember 14 -

The largest loan is for the first phase of State Farm’s two-year-old Park Center Phase 1 office tower complex that the firm constructed in Dunwoody, Ga.

By Glen FestNovember 14 -

The $785 million transaction, 2017-C41, is backed by a pool of 52 loans with an average balance of just $15.1 million, according to Kroll Bond Rating Agency; retail, hotel and office properties dominate the mix.

By Glen FestNovember 14 -

Nearly one-third of the vehicles in CIG Financial's $172 million transaction have mileage above 100,000; the highest-mileage car financed has 197,387.

By Glen FestNovember 13 -

The aerospace components manufacturer, one of the largest-held obligors in U.S. CLOs, is consolidating loans and tightening coupon spreads from 300 to 275 basis points over Libor.

By Glen FestNovember 10 -

That's only half as large as the lender's four previous deals, which ranged from $1.02 billion and $1.12 billion; company executives recently touted a shift toward more financing from deposits.

By Glen FestNovember 9 -

Over 80% of collateral for the $2 billion transaction consists of trucks, SUVs and crossovers; the deal is also the largest that the captive finance company has sponsored in the last three years.

By Glen FestNovember 9 -

For the first time in five years, MassMutual has a second securitization within a calendar year backed by loans and leases to large corporates, including federal government agencies.

By Glen FestNovember 8 -

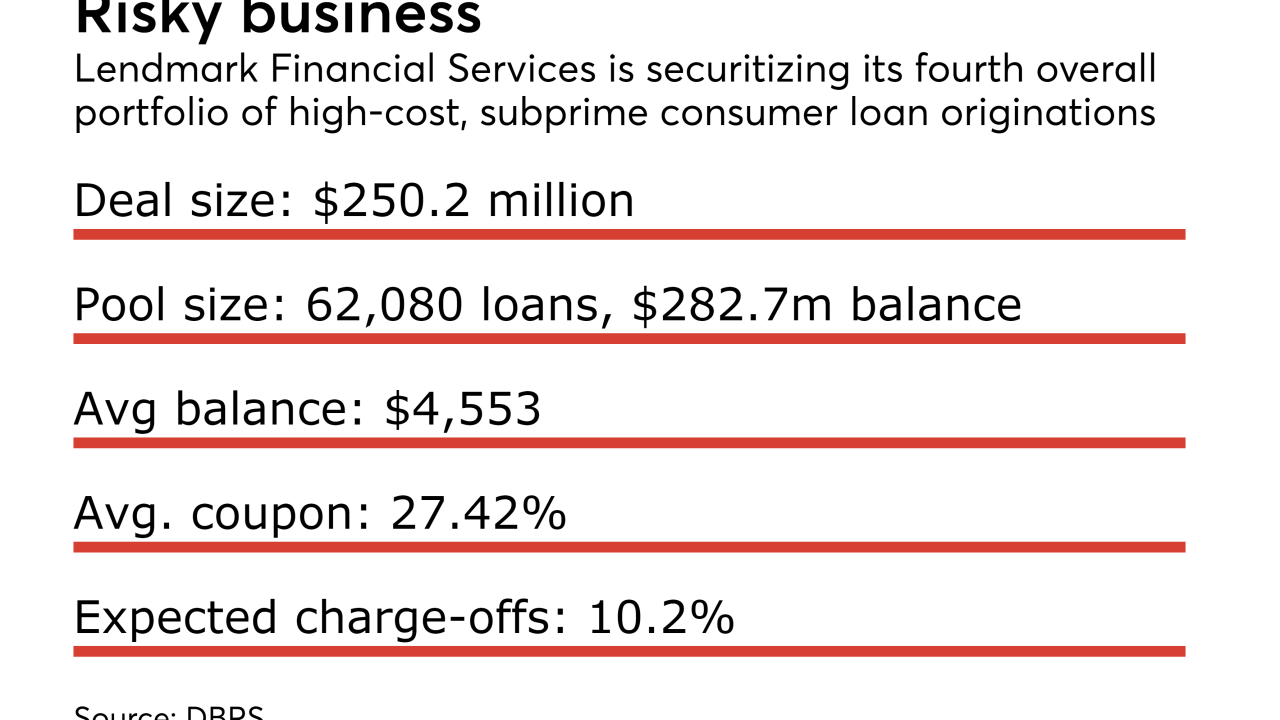

The company increased the concentration of sub-550 Beacon score borrowers to more than 13%, and cut the share of prime 700-plus loans by more than two-thirds from its prior deal.

By Glen FestNovember 8 -

Deal volume of $95 billion through 10 months is at a pace that would make 2017 the second-busiest year for post-crisis CLO issuance; AAA spreads, meanwhile, have reached three-year tights.

By Glen FestNovember 7 -

The loans are part of a €1.8 billion bad-loan purchase that Mars Capital, an Oaktree "vulture fund," made of high-risk mortgages from Irish banking authorities in 2014.

By Glen FestNovember 6 -

The $300.3 million deal will include both senior and senior-surbordinate notes secured by both floating-rate and fixed-rate loans.

By Glen FestNovember 6 -

Fitch expects cumulative net losses to reach 15% over the life of the deal ... half that of other RPL issuers.

By Glen FestOctober 27 -

The unwinding and rebuilding of the struggling portfolios of Fifth Street's business development companies could take two to three years, Oaktree management stated in an earnings call Thursday.

By Glen FestOctober 27 -

The deal, known as Bayview Opportunity Master Fund IVb Trust 2017-RT6, pools 2,745 current loans, of which nearly 58% have been clean for at least two years, and 55.2% have been modified.

By Glen FestOctober 26 -

Neuberger Berman Loan Advisors CLO 26 builds the Dallas-based manager's assets under management to $5.5 billion.

By Glen FestOctober 25 -

The captive finance arm of General Motors has been pulling back on leasing, but it still expects to be negatively impacted by falling used car prices for the remainder of the year.

By Glen FestOctober 24 -

The U.S. Second Circuit ruled that Momentive Performance Materials should use what's known a a "market rates" formula to determine the appropriate payout for a series of replacement notes issued to bondholders.

By Glen FestOctober 23